Anchor Benefit NJ

The acronym ANCHOR represents Affordable New Jersey Communities for Homeowners and Renters. People of New Jersey can have benefits for property tax reduction. These individuals can be the one who fulfill specific income requirements or who have their own or rental houses with less income.

Eligible renters and homeowners in New Jersey will get benefit payments that range from $450 to $1,500. The ANCHOR benefits NJ is awarded according to the financial situation and residency requirements of eligible individuals. The ANCHOR benefit for this year is determined by 2021 residence income and age.

ANCHOR goals are to guarantee that voluntary adherence with taxation statutes is accomplished without obstructing economic progress and to execute the state’s tax laws. ANCHOR NJ work to achieve this goal consistently, fairly, and effectively in order to optimize the revenue generated while preserving the state’s services.

ANCHOR is going to keep to distribute their benefits in a gradual fashion. After the submission their details, most of the candidates can receive the benefits in approximately 90 days. The delay may occur if some additional data is needed along with the application.

According to Division of Taxation, BJ Treasure, over 1.8 million renters and homeowners has received ANCHOR NJ benefits. The total payment spent on these benefits is more than $2.1 billion.

ANCHOR Benefit NJ 2024 Amount

Here is the list of ANCHOR benefits NJ 2024:

- The range of payments varies from $450 to $1,500.

- ANCHOR NJ provides an extra $250 benefits for candidates over 65.

- New Jersey homeowners who earn $150,000 or less will get $1,500.

- Homeowners in New Jersey who earn over $150,000 and up to $250,000 will get $1,000.

- Residents in New Jersey who earn $150,000 or less per year will get $450.

ANCHOR Benefit NJ Phone Number

The ANCHOR and Homestead Benefit Hotline may not be able to answer your call at specific periods due to excessive call volume. Try to call at a different time if it happens. ANCHOR team is available from 8:30 a.m. to 5:30 p.m., Monday to Friday.

Here are the phone numbers of ANCHOR NJ

- 609-826-4282

- 1-888-238-1233

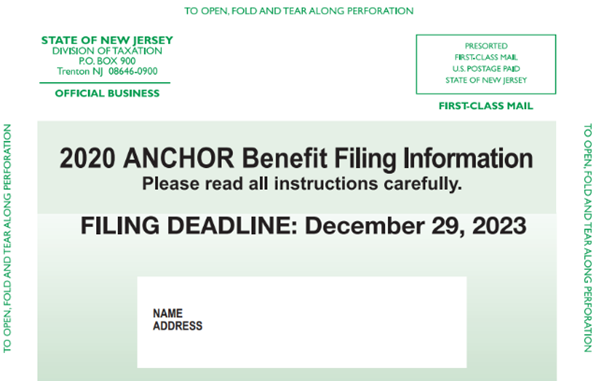

ANCHOR Benefit NJ 2023

Residents of New Jersey who matched the less income are eligible for property tax reduction under this program. These individuals can be among those who either owned or rented their primary residing (main home) on October 1, 2021.

Rather of being credited to property-related bills, ANCHOR contributions will be made by check or direct deposit. It may be possible for homeowners who applied for Homestead Benefits last year to get their ID and PIN numbers online.

ANCHOR Benefit NJ 2021

You are deemed a homeowner if:

- you were either a resident shareholder of a co-operative housing complex by October 1, 2020

- owned a house or condominium and paid property taxes on your apartment

- were a citizen of a continued care retirement group

- your continuing concern contract required you to cover your appropriate percentage of property taxes due to your unit

If you made P.I.L.O.T. (Payments-in-Lieu-of-Tax) payments or your dwelling was fully exempt from property tax, you are not eligible.

You are regarded as an eligible renter if you:

- rented a home, apartment, or condominium by October 1, 2020;

- owned or rented a mobile home in a park for mobile homes

If you resided in campus, subsidized, or tax-exempt housing you are ineligible.

ANCHOR Benefit NJ Renters

New Jersey inhabitant with an annual income of $150,000 or less per year will get ANCHOR benefit of $450. Homeowners whose earning is $150,000 or less will get ANCHOR benefit of $1,500. Individuals with earning of over $150,000 and up to $250,000 will get ANCHOR benefit of $1,000. You must pay your rents in order to be qualified for ANCHOR NJ benefits.

ANCHOR Benefit NJ How Much

Here is the table of ANCHOR benefits as per age and gross income:

| Gross Income (NJ-1040 Line 29) | age 64 or younger | age 65 or older |

| $150,000 or less | $1,500 | $1,750 |

| $150,001 – $250,000 | $1,000 | $1,250 |

ANCHOR Benefit NJ Payment Date

The last date to submit the applications to enjoy ANCHOR benefits is November 30, 2024. You have a month to submit your applications.

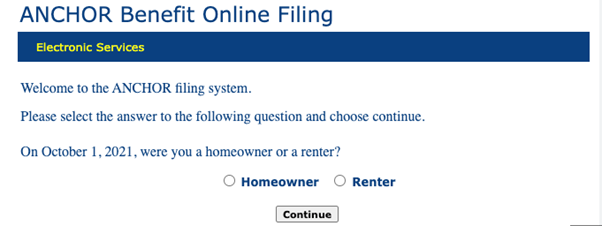

ANCHOR Benefit NJ Online Filing

You must go to the official ANCHOR filing system in order to submit an online application for the ANCHOR benefit in New Jersey.

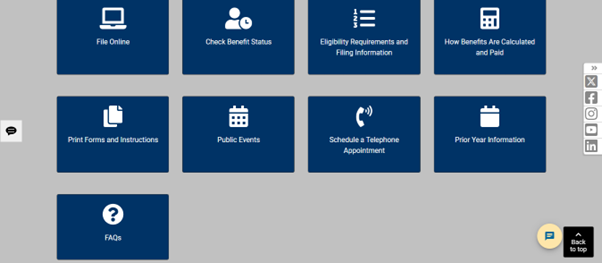

Here is the process of online filing of applications for ANCHOR benefits:

- Go to ANCHOR official site https://www.nj.gov/treasury/taxation/anchor/

- In the drop-down menu, click ‘file online’ option

- It will require you to make an account, follow the information and add your credentials.

- As these factors are considered for eligibility

- verify that you have the required data

- They require some essential data such as:

- your age in 2021

- Your income

- Your residency status

- Click the submit option after filing the necessary information

- They will send a PIN to your registered email or phone number

Is there a 2024 ANCHOR Benefit in NJ?

Yes, ANCHOR is continuing to provide the benefits in 2024. Homeowners and renters received confirmation letters about the 2024 NJ Anchor Rebate benefit from the New Jersey Department of Treasury in August.

What is ANCHOR Benefit NJ Amount?

The benefit amount by ANCHOR varied according to the income and age of the residents. Residents will get $450 if can earn $150,000 or less per year. Homeowners get $1,500 if they earn $150,000 or less will.

When Can I Expect My ANCHOR Rebate in NJ?

Mainly all the rebate applicants of ANCHOR rebate anticipate receiving their money about 90 days after submitting their application. The start of payments is scheduled for mid-October 2024. Payment may get delay if further information is needed to process the application.

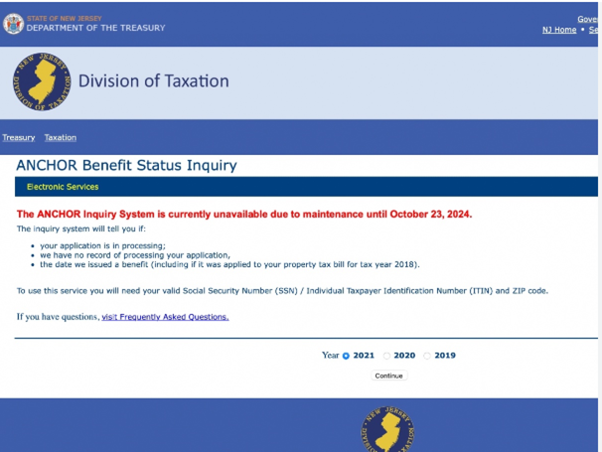

How Do I check my NJ ANCHOR Status?

At anchor.nj.gov, applicants can monitor the current state of their benefit online. Candidates should anticipate receiving fresh information regarding the status of their application no more than twice a week, as the benefit status monitoring tool is refreshed twice per week.

Here is the process to check NJ ANCHOR benefits status:

- Visit the official site of ANCHOR: https://www.nj.gov/treasury/taxation/anchor/

- Move down below to the option of ‘check benefit status’

- Add the necessary information, like username, PIN etc.

- It will direct you to your application status

Is NJ ANCHOR Benefit Real?

Yes, ANCHOR benefit NJ is real. Anchor benefits, which are paid from the state’s annual budget, vary from $450 to $1,750 based on residency, age, and income. Last year, ANCHOR checks or electronic payments were made to around 2 million tenants and homeowners.

Is It Too late to Apply for NJ ANCHOR Benefit?

You can still apply for NJ ANCHOR benefits.Applications must be submitted by November 30, 2024.

Is Everyone in NJ Getting a $500 Dollar Check?

In New Jersey, married individuals who earn less than $150,000 and have at least a dependent child been eligible for a rebate check. Those who earn less than $75,000 and have at least a single dependent child been eligible to get ANCHOR benefit check.

Will There be an ANCHOR Benefit in 2025 in NJ?

Yes, ANCHOR is going to provide benefits in 2025. Even though the average New Jersey property-tax payment is continually growing, program specifics included in the fiscal year 2025 budget state that ANCHOR benefits will not increase. It will remain the same as the amounts received by previous year.

Can I Track My NJ Rebate Check?

Here are the ways to track your NJ rebate check:

- Talk to a Division Representative by giving the Customer Service Center a call at 609-292-6400. The check will be tracked by the Division.

- You can also call the Division’s Automated return Inquiry System at 1-800-323-4400 to request a check tracer for your current year’s New Jersey Income Tax return check.

Is NJ Giving Out Stimulus Checks in 2024?

For qualified residents, the NJ Stimulus Check 2024 is anticipated to offer substantial relief. It is anticipated to put a strong emphasis on providing the aid to pandemic affected individuals who are dealing with the inflationary pressures. New Jersey provided a $1,500 stimulus check to eligible residents on January 10, 2024. These were the one who was affected by recent economic difficulties.

Why is My NJ Refund Taking So Long?

The procedure will take more time than usual if:

- the department wants to confirm details about the paperwork or ask for additional details

- Your return may contain math errors or other changes

- You filled out your return using several form types

- Your response was either incomplete or missing data.

How to Check NJ Refund Status?

Here are the ways to check NJ refund status:

- “Check Your Refund Status” option on the New Jersey Division of Taxation’s website.

- Give ANCHOR representative a call at 1-800-323-4400 or 609-826-4400 to find out your NJ refund status.