Anchor Benefit NJ Status

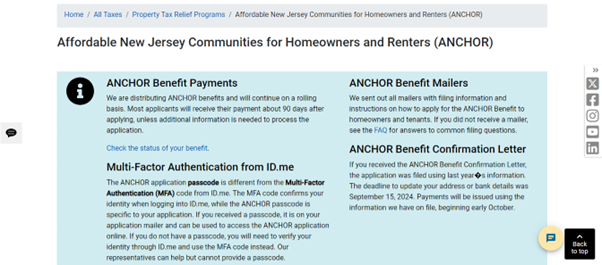

Individuals who are eligible to get ANCHOR benefits might receive between $450 and $1,750 back directly through the ANCHOR (Affordable New Jersey Communities for Homeowners and Renters) program. It is anticipated that checks for the 1.5 million individuals who were immediately enrolled will begin to be sent out in October.

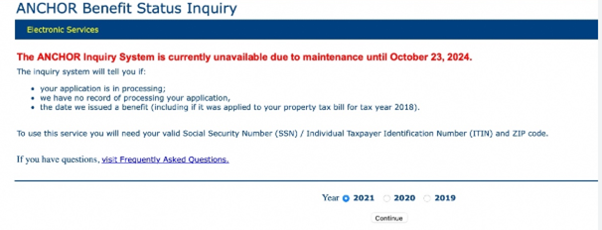

The tax data used in this year’s ANCHOR program comes from Fiscal Year 2021. By choosing that year from the list of possibilities, both renters and homeowners can check ANCHOR Benefit NJ Status of their applications online.

People can check the website to verify when the government has granted a benefit and whether their application is still being processed. You will also be informed if there is no record of the state considering your application.

With more than one month before the deadline of November 30, there is still time for new candidates to enroll in New Jersey’s ANCHOR property tax relief program. Additionally, the state Division of Taxation has modified its website so that individuals can verify if the state has been given their data and check their benefit status.

It would be for those who will be getting their refund automatically or who have previously submitted their applications for benefits. According to a Department of the Treasury study released by the state assembly, almost 2 million people are anticipated to be eligible for an ANCHOR benefit this year.

This quantity is increased from 1.8 million in the previous year and 1.6 million in 2022. According to officials, ANCHOR Benefit program distributed about $2 billion last year.

How Do I Check My NJ ANCHOR Status?

Applicants can check the status of their benefits online at anchor.nj.gov. The benefit status tracking tool is updated two times per week. You should expect to get new information on the current state of their request for benefits twice a week.

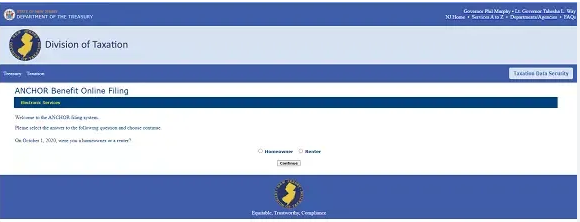

To find out your NJ ANCHOR status, follow these steps:

- The ANCHOR website can be accessed at https://www.nj.gov/treasury/taxation/anchor/.

- Select “check benefit status” from the menu below.

- Include the required data, such as the PIN and username.

- You will be directed to the status of your application.

Can I Track My NJ Rebate Check?

Yes, you can track your NJ rebate check. Your rebate check can be tracked by ANCHOR team. It is necessary to make a call to Customer Service Center at 609-292-6400 and talk to the Division Representative, so that they can track your check. Division’s Automated return Inquiry System at 1-800-323-4400 can also track your NJ rebate check once you make a call.

When to Expect NJ ANCHOR Payment?

About 90 days after submitting your application, you will begin receiving the funds. The payment is sent on a rolling basis. If the department wishes to verify information on the document or request more information, the process will take longer.

How to Recheck NJ Refund Status?

The New Jersey Division of Taxation has two ways to check the status of your tax return:

- you can make a call at 609-826-4400 or 1-800-323-4400

- you can use the “Check Your Refund Status” option on their website.

The online check requires that you provide the Social Security number you used to register and the precise amount of your refund as it appears on your tax return.

Is Everyone in NJ Getting a $500 Dollar Check?

In New Jersey, Individuals who get married and have one dependent child, while they can earn under $150,000 are approved for a rebate payment.

Can We Check Refund Status Online?

Applicants can visit anchor.nj.gov to check the refund status online.

Can You Track a Refund?

Yes, you can use particular tools or techniques depending on the kind of refund to track it. For instance, approximately 24 hours after electronically filing a return, you can check the status of your tax refund online. You can use the reference number in the Stripe Dashboard to track down a refund when dealing with payment processors like Stripe. There is an automatic self-help flow for Google Play refunds that allows you to monitor the progress of your reimbursement.

Why Can’t I track My Refund Status?

There may be the following reason why you can not track your refund status. You are checking it while less than four weeks have passed since you mailed your return. Before employing WMR, paper filers should wait four weeks. Early filers may overload WMR in late January or early February. Instead, dial the automated WMR helpline at 1-800-829-1954.

What App Can I Check My Refund Status?

You can use IRS2Go to check your refund. You can obtain a copy or transcript of your tax records or locate the details of your taxes in your online account.